Jones Act Harms Hawaii Residents

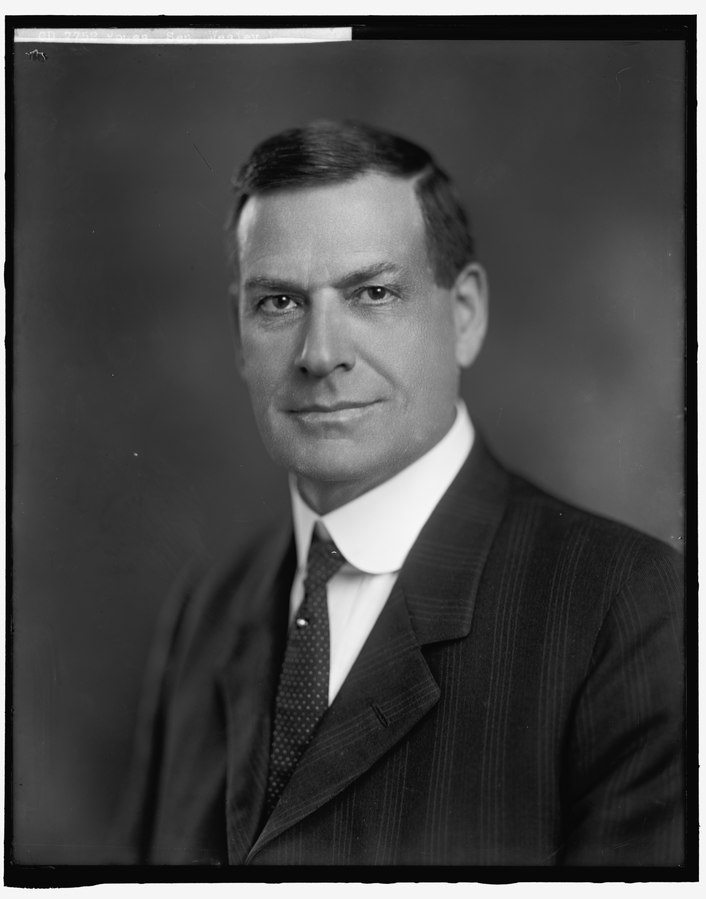

Former Senator Wesley Jones of Washington state is the namesake of the Jones Act. He hoped that the act would make Alaska dependent on Seattle-based shipping. (Photo Credit: Library of Congress)

September 23, 2022

Hawaii is consistently ranked as the least affordable state to live in. Groceries, housing, and gasoline are all notoriously expensive. Much of the blame lies with an archaic 102-year-old federal law known as the Jones Act.

Section 27 of the Merchant Marine Act of 1920, commonly known as the Jones Act, requires vessels carrying trade between two ports in the United States to be built in the U.S., owned by U.S. citizens, crewed by U.S. citizens, and flagged in the U.S. The stated purpose of the law was to “have a merchant marine of the best equipped and most suitable types of vessels sufficient to carry the greater portion of its commerce…” The Jones Act has not achieved this purpose. Instead, it has made America’s shipping fleet less competitive and increased prices for consumers. Decreased domestic competition led American shipping companies to underinvest in their foreign operations. America’s shipping fleet accounts for just 0.4% of the global total today. Additionally, the number of ships that are Jones Act compliant has been declining as well. Between 2000 and 2019, the number of Jones Act compliant ships declined from 193 to 99. Clearly, the Jones Act has not supported the country’s shipping industry as intended, but rather, destroyed it.

The Jones Act’s impact on Hawaii residents is profound. It is estimated that the Jones Act increases the average family’s housing cost by $1, their food bills by $0.40, and their electricity bills by $0.14… every day. In all, the average Hawaii family spends about $5 every day to support the Jones Act. On average, the Jones Act costs each Hawaii resident over $645 every year.

Hawaii would have much to gain from a repeal of the Jones Act. According to estimates, the Jones Act costs the Hawaii economy $1.2 billion each year. Additionally, with the Jones Act, it is expected that the annual cost of shipping to Hawaii is $654 million higher and, as a result, prices are $916 million higher. With the Jones Act, there are about 9,100 fewer jobs. Without it, tax revenues would be about $148.2 million higher.

The Jones Act has also increased Hawaii’s dependence on foreign oil. This is important because 60% of Hawaii’s electricity generation comes from imported petroleum. Recently, the Jones Act has made efforts to cut off imports of Russian oil and gas amid the war in Ukraine harder. This is because there are too few LNG (liquefied natural gas) ships that are compliant with the Jones Act. In fact, there are only two Jones Act compliant LNG vessels and they are barges used primarily to refuel other vessels. As a result, it is often harder to import oil to Hawaii from other parts of the U.S. than from foreign countries. Repealing the Jones Act would make it easier to transport domestically produced oil to other parts of the U.S. and make the U.S. less reliant on foreign oil.

The Jones Act also has negative environmental consequences. Higher sea-freight rates from the Jones Act push cargo onto trucks, trains, and planes. These forms of transportation can produce up to 145 times as many carbon emissions.

Supporters of the Jones Act argue that it protects American jobs without adding to consumer prices. In fact, the Jones Act has led to fewer American jobs. Approximately 300 U.S. shipyards closed between 1983 and 2013. Today, there are only four shipyards in the entire country that build large oceangoing commercial ships. High shipping costs as a result of the Jones Act led Hawaii’s last sugar plantation to close. It is also clear that the Jones Act has a considerable effect on consumer prices, especially in Hawaii and other non-contiguous parts of the U.S. The Jones Act costs Hawaii about $1.2 billion annually.

Various Jones Act reforms would benefit Hawaii. Eliminating the requirement that ships be built in the U.S. would lead to more ships in service and lower prices for Hawaii consumers, as U.S. ships usually cost four to five times more to build. Another option would be exempting non-contiguous areas of the U.S. (including Alaska, Hawaii, Puerto Rico, and Guam) from the Jones Act. The U.S. Virgin Islands, American Samoa, and the Northern Mariana Islands are already exempted from the Jones Act. In Puerto Rico, American goods shipped there can be twice as expensive as American goods shipped to the U.S. Virgin Islands, which are exempt. According to the Organization for Economic Co-operation and Development (OECD), repealing the Jones Act would increase the United States’ economic output in the long term by between $40 billion and $135 billion a year. Repealing the Jones Act would also lead to lower prices in Hawaii. You can help reform the Jones Act by spreading awareness and by letting your elected officials know about how the law impacts you.